What Is Title Insurance & How Does it Work?

To put it simply, title insurance is a way to protect yourself from financial loss and related legal expenses in the event there is a defect in title to your property that is covered by the policy. Title insurance differs from other types of insurance in that it focuses on risk prevention, rather than risk assumption. With title insurance, title examiners review the history of your property and seek to eliminate title issues before the purchase occurs. Title insurance also differs in that it comes with no monthly payment. It’s just a one-time premium paid at closing.

Do I Need Title Insurance?

Absolutely. Title insurance is a way to protect what is likely your largest investment—your home. An Owner’s Policy provides peace of mind that your title company will stand behind you if a covered title issue or defect arises after you have bought your home.

What Does Title Insurance Cover?

Any number of title issues may arise, even after the most meticulous search of public records. These hidden defects are dangerous because you might not learn about them for months, or even years, after purchase. Some common examples of risks covered by your Owner’s Policy include defects in title caused by:

- Improper execution of documents

- Mistakes in recording or indexing legal documents

- Forgeries and fraud

- Undisclosed or missing heirs

- Unpaid taxes and assessments

- Unpaid judgments and liens

- Unreleased mortgages

- Mental incompetence of grantors on the deed

- Impersonation of the true owners of the land by fraudulent persons

- Refusal of a potential purchaser to accept title based on the condition of the title

How Much Does Title Insurance Cost?

The one-time premium that you’ll pay for a title insurance policy varies by state, but generally is related to the value of your property.

What’s Owner’s Title Insurance?

An Owner’s Title Policy is designed to protect you from covered title defects that existed prior to the issue date of your policy. If a valid claim is filed, your Owner’s Policy, subject to its terms and conditions, will cover financial loss up to the face amount of your policy.

What’s Lender’s Title Insurance?

A Lender’s Policy provides no coverage to the homeowner. A Lender’s Policy insures that your lender has a valid, enforceable lien on your property. Most lenders require borrowers to purchase this type of insurance policy to protect their investment.

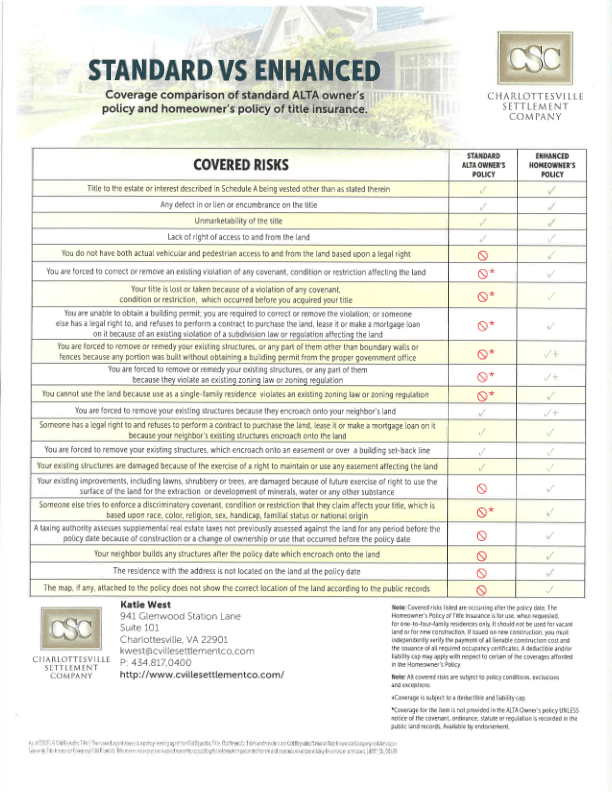

Title Comparison

If a title claim is made, the lender’s coverage comes into effect only after your equity in the property is exhausted. To protect against this, there are two options: Types of Owner’s Coverage—Standard or Enhanced.

1. Standard:

Protects your equity from various title defects as well as the cost of any legal defense of your title. Among other items, coverage includes protection against: creditor claims; deeds executed under false or expired powers of attorney; mistaken interpretation of wills and trusts; fraudulent or incorrect representation of marital status; errors arising from estate administration; undisclosed heirs; mistakes in recording; incorrect legal descriptions; forged documents; federal and state inheritance and gift tax liens; errors in the conduct of a foreclosure; errors in tax records; capacity of foreign fiduciaries; duress in execution of documents; deeds from minors or non-existent entities; discovery of a later will after probate of a prior will; and easements by prescription not discovered by survey.

2. Enhanced:

Provides even greater protection beyond the standard policy. It includes automatic inflation protection up to 50% above your purchase price; enhanced access coverage; building permit and zoning violation coverage; subdivision law violation coverage; enhanced encroachment coverage; mechanic’s lien coverage and post policy forgery.

Here’s a comparison of what typical coverage you receive in a standard policy and an enhanced policy.

Need more information? Call us at (434) 817-0400 to speak with one of our experts.